Acquisition project | NAT HABIT

Hi there, we'll take this one step at a time!

If you struggle with a blank canvas, use this boilerplate to start. Remember, this is a flexible resource—tweak it as needed. Some sections might not apply to your product and you might come up with great ideas not listed here, don't let be restricted.

This is not the only format, we would love to see you scope out a great format for your product!

Go wild and dive deep—we love well-researched documents that cover all bases with depth and understanding.

Section | Details |

Hook | How many toxic chemicals are you exposing your body to every day, through your hair care products? |

Value | At Nat Habit, we offer 100% natural, highly effective products made from the freshest of ingredients, without the chemicals and synthetics your body doesn’t need. |

Evidence | Studies show that your scalp absorbs up to 60% of what’s applied to it. Don’t let harmful chemicals be part of the mix. Choose products that are as pure as nature intended. |

Differentiator | Unlike most brands, Nat Habit uses only natural, herbal ingredients, free from synthetic chemicals or harmful additives. Our products are clean, ethical, and effective. |

Call to Action | Make the switch to Nat Habit. Give your hair what it truly deserves with our natural solutions. |

Section 1 : 5 user interviews

Criteria | User 1 | User 2 | User 3 | User 4 | User 5 | User 6 |

Name | Monika Nawani(GX24) | Sabrina Fernandes | Insiya Merchant | Aanchal Aggarwal | Kanupriya Agarwal | Ananya Mehta |

Occupation | Working Professional | Business Owner | House wife | House wife | Blogger, Youtuber | Working Professional |

Persona Type | Health & Ingredient Conscious | Health & Ingredient Conscious | Expecting Mother | New Mother | Stress Relief + Hair fall | Beauty Explorer/ Trend Seeker |

Age | 32 | 41 | 29 | 29 | 40 | 27 |

Gender | Female | Female | Female | Female | Female | Female |

Income Level | Upper Middle Class | Upper Middle Class | Upper Middle Class | Upper Middle Class | Upper Middle Class | Upper Middle Class |

Married | No | Yes | Yes | Yes | Yes | Yes |

Primary need + pain points( product related) | Clean, organic products made with natural for hair | Clean, organic natural ingredient products for hair | Natural, herbal/ organic products, safe for both mom and baby | Natural, herbal/ organic products, safe for both mom and baby | Needs pure ingredients due to medical condition | Needs pure ingredients due to medical condition |

No hair concerns per se. Generally wants to use only natural products | - Wishes to hide greys naturally. - Does not want to use chemical hair dyes on her hair. | - Hair fall due to pregnancy | - Hair fall due to pregnancy and hormonal changes post pregnancy routine changes like lack of sleep, stress | -Hair fall due to stress and thyroid problems | Wants a product that can solve her hairfall issues for good | |

Secondary Pain Point | 1.Difficulty to find cold pressed extremely natural oil hence relies on the brand | 1. Difficulty finding reliable organic hair dyes that are 100% natural and effective and stain hair black 2. Synthetic colors ruined her hair hence has switched over to natural ways of coloring hair. 3. In addition to henna - also wants something that helps the color stay for longer so she doesn't need to dye frequently. | 1. Is uncertain about what's safe for baby- overthinks what to be used on self 2. Worries about chemicals in products 3. Is torn between modern medicine and Ayurveda- conflicted between following culture and trying new trends 4. Pressured to stick to old-school practices 5. Struggles to find pregnancy-specific ayurvedic haircare that isn't from a local chemist and unbranded. 7. Needs products that are quick and easy to use 8. Frustrated with expensive products that don’t work 9. Experiences hair fall due to pregnancy | 1. Dry itchy scalp + brittle hair due to hormonal changes after pregnancy. 2. Is uncertain about what's safe for baby- overthinks what to be used on self ( breastfeeding) 3. Is torn between modern medicine and Ayurveda- conflicted between following culture and trying new trends 4. Pressured to stick to old-school practices 5. Struggles to find pregnancy-specific ayurvedic haircare that isn't from a local chemist and unbranded. 7. Needs products that are quick and easy to use. 8. Frustrated with expensive products that don’t work | 1. Difficulty finding reliable organic brands that give pure oils. 2. Natural oil is a must in her regimen as it will help balance her hormones that are off due to thyroid. 3. Wants to stabilize her TSH levels | 1. Experiences hairfall problems due to lifestyle disorders and is working towards fixing it. 2. Has tried all brands under the roof and wishes to give NAT HABIT a fair chance now to see if it stands upto its claims of being natural and effective. |

Product Used | Hair mask, Hair Oil, Hair Spray | Henna | Hair oils, Hair mask, Shampoo, Castor Oil, | Hair oils, Hair mask | Essential Oils | Neem comb, hair mask, hair oil, methi jal, shampoo, conditioner |

Frequency of use case | Once a week | Once a month | Three times a week | Three times a week | Three times a week | Three times a week |

Behavior | - Is into all things healthy. - Reads labels of products - Ingredient conscious - Believes in prevention is better than cure hence actively invests in self care - Stays away from synthetic chemical-laden products. - Does not trust 'ghar ke nuske'. (does not trust its efficacy as proportions + ingredients sourced may or may not be accurate) - Is into yoga and fitness | - Skeptical of local hennas sourced and the ingredient quality. - Is fearful of the same as composition changes very time. | -Spends a lot of time researching on health of baby and herself. - consumes a lot of content around the same -Very ingredient conscious at the moment. wasn't previously like this - Is worried about all the bodily changes she is undergoing and actively takes measures to reduce damage done during pregnancy. | -Spends a lot of time researching on health of baby and herself. - consumes a lot of content around the same -Very ingredient conscious at the moment. wasn't previously like this - Is worried about all the bodily changes she is undergoing and actively takes measures to reduce damage done during pregnancy. | - Recently got into yoga and meditation - Does walnut oil massage of the glands every night - Struggled to find pure walnut oil - Uses oils for head massages and essential oils as mixers. - Uses essential oils in her diffusers too occasionally. | - Keeps trying different organic brands- juicy chemistry, kama, forest essential mists/ sprays. - Recently turned to clean ingredients due to acute hair fall |

Perceived Value of Brand | Really likes the brand. Deep trust in brands offering Ayurvedic formulations and natural ingredients. The brand video helped build trust about their ingredients. The fact that the shelf life is low helps her gain more trust in the brand. | Really loves the henna of the brand. Deep trust in brands offering Ayurvedic formulations and natural ingredients. The fact that it is the bestseller on Amazon helped her identify it which eventually led to purchase | Still figuring out if she likes the brand. Hair issues haven't gone away completely yet. | Really likes the fact that the shelf life is low- hence signaling that it is pure. Has seen an improvement in her hair post usage of products | Tested it out for the very first time. No comments yet | Tested it out for the very first time. No comments yet |

Amount spent on self care monthly ( In rs) | 5000 | 6000 | 7000 | 4000 | 4000 | 5000 |

Goals | To maintain a natural, holistic lifestyle with products that promote well-being and good health. | - Wishes to hide greys naturally. - Does not want to use chemical hair dyes on her hair. | - Wants to stop / reverse hair fall due to pregnancy | - Wants to stop / reverse hair fall due to pregnancy, hormonal changes post pregnancy routine changes like lack of sleep, stress | -Wants to reverse hair fall due to stress and thyroid problems | Wants a product that can solve her hairfall issues for good |

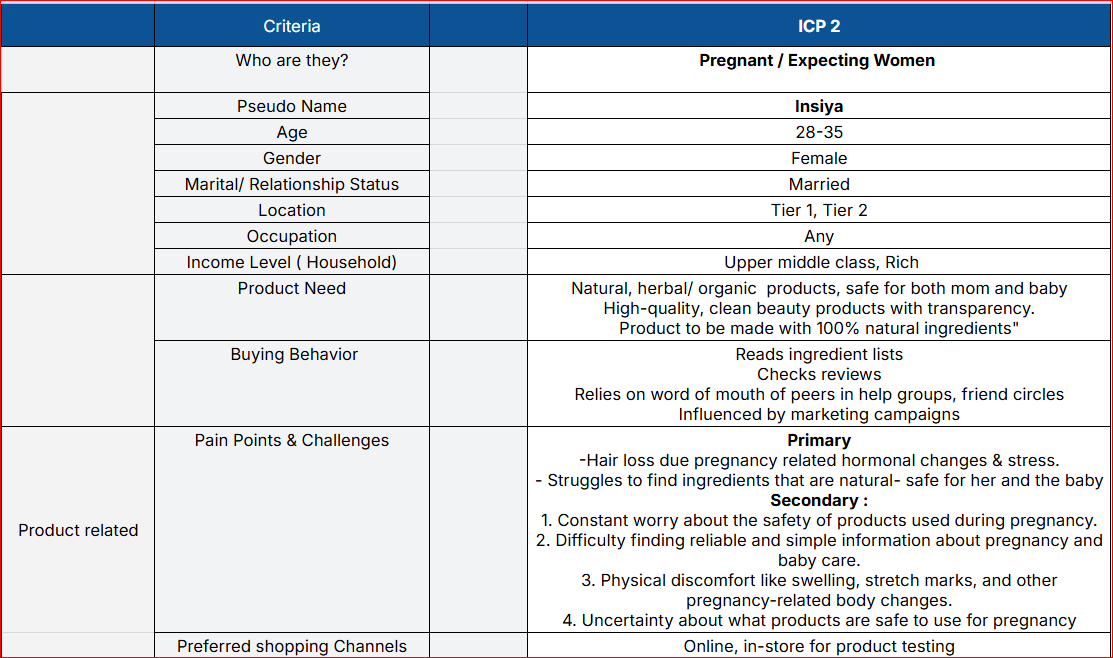

Section 2 : Create 3 Ideal Customer Profiles ( ICPS)

PFA Complete view of ICP profile here

Section 3 : ICP prioritization

Basis the framework- the ICPs above can be prioritized accordingly

(Before you begin, you need to know what your product is, what are its features, what is the problem being solved by your product?)

Understanding Core Value Proposition

(Build your core value proposition by exact what your product does and what problem are you solving)

Product selected

Company -NAT HABIT

Sub products under this category are:

Hair

- Hair Masks

- Henna

- Hair Oils

- Neem Comb

- Conditioners

- Shampoos

Trying to solve the following problems/ pain points

- Ayurvedic Hair care products with 100 % authentic ingredients

- Authentic ingredients that are also the freshest

- Sourced from pesticide free herbs, plants, fruits and nuts

- No SLS, fragrances, parabens at all.

- Ayurveda, natural and organic products automatically cost a lot- wish to change that with Mass premium price point- to assure quality as well as accessibility. No, ayurveda was never and does not only have to be for the rich and the rich alone!

- Shelf life may not be high due to elimination of preservatives

- Safe for pregnant mothers, breastfeeding mothers

- Effective on those struggling for hair issues

- Clean in its truest sense

- Make ayurveda cool and appealing to the younger aundience as well with fun and vibrant yet sustainable packaging + branding ( Not a dated brand but something relatable)

Some user reviews of the product

High search frequency on amazon testifying consumer love for some of the hair care products such as henna, shampoo, hair mask

Customer insights around the product- Positives

- Strong brand pull for hair care segment

- Henna is amazon best seller

- 4 + ratings on ASINs is testament to the fact that product is of superior quality and loved by the customers using it.

Some Negatives

- Users put off by the smell of hair masks

Core Value Proposition

🌿 For those who refuse to settle for products that fall short of their promises and quality, our Ayurvedic hair care offers 100% natural, highly effective products. Crafted with the finest, pesticide-free ingredients, our products bring the magic of nature to your hair, delivering the results you expect without compromise. 🌿

Part 1: Analysis of Market Trends + Tail winds

NirogStreet said the Ayurveda product market in India is expected to grow significantly, with projections indicating a substantial increase in market value to Rs 1,20,660 crore ($16.27 billion) by FY28.

The overall ayurvedic market that NAT HABIT taps into is growing at 15% CAGR from FY23-FY28. ( As per Nirogstreet survey)

Let's use PESTLE (Political, Economic, Social, Technological, Legal, Environmental) framework to evaluate & understand the market trends and tailwinds better.

1. Political & Legal Trends

- Regulation on Transparent Labeling

- Tax Incentives for Ayurvedic Products

- Increased Regulatory Focus on Natural Ingredients

- Govt. support for Ayurveda through NAM (National Ayush Mission)

- Indian government's emphasis on preventive healthcare and wellness as part of the National Health Policy

- Political support for the export of Ayurvedic products through schemes like MEIS (Merchandise Exports from India Scheme) has helped boost India's presence in the global clean beauty and wellness markets.

2. Economic & Behavioral Trends

- Rising Disposable Incomes

- Change in consumption pattern.

-Moving away from synthetic to and opting for clean

-More health conscious

-New behavioural change of reading ingredients

-Actively looking to decrease toxins ;in, on and around them

- Market expansion of natural products.The global natural cosmetics market was valued at $34 billion in 2020 and is expected to grow at a 9.3% compound annual growth rate (CAGR), showcasing the economic potential in the shift toward natural ingredients. There's a tendency to ape the west. Trends there are now reflecting in India as well.

3 . Social Trends

- Growing consumer awareness around health, wellness that supports the clean beauty trend.

- Changing attitudes toward personal self-care, sustainability, and natural ingredients influence purchasing decisions.

- With increase in ingredient transparency, consumers are more conscious about what’s in their beauty products.

- Social media, blogs, and wellness influencers have made it easier for people to educate themselves about harmful chemicals like parabens, phthalates, and sulfates.

4.Technological trends

- Growth of Online Retail and E-commerce making it easier for clean beauty brands to reach a broader audience via online platforms.

- Change in behavior here is reflected in how most technological portals are built out today. The consumer journey itself is designed to aid this discovery through clean ingredients versus generic keywords like " shampoo, conditioner, face wash" and the likes.

- Technological access to information, social media, and wellness influencers have made it easier for people to educate themselves about harmful chemicals like parabens, phthalates, and sulfates.

6.Environmental

- Growing concern and interest in sustainability, carbon footprint, and plastic waste is pushing brands toward eco-friendly packaging and sustainable sourcing of ingredients. Ayurveda’s focus on plant-based ingredients naturally supports environmental consciousness, helping brands like Nat Habit promote green beauty.

- Increase in pollution has led to increase in skin damage leading to switching to more effective products as opposed to generic products that only solve for dirt.

- Endocrine Disruption due to toxins in the environment and Increased Health Problems - has led to people opting for cleaner solutions

Part 2: Competitor Analysis

PFA - complete competitor analysis here-

Part 3: Market Size and TAM calculation

Please find attached -complete Market size calculation here

Summary of TAM calculation

Designing Acquisition Channel

Early scaling requires experimentation.

Any channel that satisfies 3 out of 3 conditions of ( Cost, flexibility and effort) qualifies as ideal channel to scale.

If a channel satisfies 3/3 conditions ( Cost, flexibility and effort) -It is deemed ideal.

If a channel satisfies 2/3 conditions ( Cost, flexibility and effort) -It is good

Basis this framework, and factoring stage of the company- ( i.e Early stage)

The ideal channels are

Organic

Content Loops

Paid Ads

Referral

The following channels should be tapped into for experimentation and scaling of products for NAT HABIT at the moment.

Organic Channel

(Understand the existing organic channel strategy for your product and highlight the success and failure thereon.

Provide your suggestions and devise new strategies.)

Step 1 → Conduct keyword research on Google, Amazon, Youtube, Quora etc.

Step 2 → Collate all your insights from all your searches.

Step 1 - Defining ICP

Step 2 - Analyzing the ICP's journey

According to the search queries on google console + semrush : highest search is around these topical buckets

Hence as per data, ICP is looking for one or more of the following

Examples | ||

1 | Ingredients ( Generic) | eucalyptus, olive, moringa |

2 | Product ( Generic) | shampoo, oil, henna etc |

2 | Problem | Dandruff, dry skin, oily skin |

3 | Product name + brand | Nat habit henna |

4 | Product name + competitor brand | Kama Ayurveda Oil |

Let's consider a situation where ICP is looking to buy henna

The ICP would tap into one or more of the following search options:

Conversion will always be low on competitor keyword as intent is strong and the consumer has already made up their mind- it's hard to get them to change- BUT not impossible- hence deemed low and NOT a NO or impossible

Step 3 - Identifying Gaps (Auditing for different channels)

SEO

All organic search for NAT HABIT comes from the following bucket of keywords as shown below

- Branded

2.Unbranded

While branded search is a function of distribution of spends across paid channels and brand pull,

a very straight forward way to get more people similar to the ICP persona would be -

- Identify Gaps basis keyword comparison with competitors such as forest essential, kama ayurveda etc

- Basis interest and behaviour of said customer

Let's look at option 1:

Identify Gaps basis keyword comparison with competitors

Nat habit currently taps into searches of about 4.3k keywords whereas its competitors have blogs and site map indexing over 18k keyword! That's a massive gap itself.

Some of these keywords basis comparison were

High volume and low KD. Perfect to get in more traffic that matches their existing product line as well.

- Basis interest and behavior of said ideal customer persona type

Basis our understanding of the customer persona and user calls, there is a tendency for people drawn to natural and organic products to also be health conscious, drawn to yoga and indulge heavily in self care.

Some potential keywords that could draw a user into exploring NAT habit products and eventually purchasing them could be:

For example:

A) Face Yoga

A blog or content piece for someone on face yoga could very well branch out to introducing oils that will help during their regimen for face glow.

B) Yoga for hair growth could extend to becoming in addition to doing yoga- try this hair mask or oil for best results.

Additional levers to optimize on to improve SEO

Get more backlinks

Fix broken links / pages

Google Trends

NAT HABIT vs competitors- Google Trends over 12 months. Brand search is dipping slightly at the moment.

Content Loop

(Keep it simple and get the basics right)

Step 1 → Nail down your content creator, content distributor and your channel of distribution

Step 2 → Decide which type of loop you want to build out.

Step 3 → Create a simple flow diagram to represent the content loop.

Top platform+ apps the audience spends max time on are:

- Youtube

- Telegram

- Quora

- Nykaa

- Myntra

- Spotify

Content loop systems for NATHABIT should ideally comprise of

- Blogs ( for organic reach)- shareability is not high- only relying on google for growth

- Instagram - for social proof

- A viral loop

Why viral loop?

For one or more following reasons

- Exponential Growth

- High Engagement

- Faster + Cheapest Brand Awareness & Reach

- Faster Results

- Low Cost

- Better Algorithmic Boost

Analyzing how viral content loop would work on different platforms

Exploring youtube as a medium for viral loop.

The content loop with the highest discoverability basis past data is the most apt selection. Let's explore this further

Hook:

People like to watch other people- some of the highest views on Youtube have been garnered by VOX pop videos of people talking to other people and even at times asking the most pointless/ bizzare questions.

In this case some of them can be :

- Is your hair tangled?

- Strangest thing applied to your hair?

- What's the strangest thing according to you someone may have applied to their hair?

- What do you do today that helps you have great hair tomorrow?

No selling of product here. Just getting people familiar with the brand and topically nudging them into the direction of hair care

This can go 2 ways

- Video is funny-

Generator:

The brand itself

Distributor:

Viewer through DMs / whatsapp

- Video isn't funny-

Generator:

The brand itself

Distributor:

The Platform through SEO + further impetus through engagement

(Understand what is already being done, what is working out well and what needs to be stopped)

Step 1 → Define the CAC: LTV ratio. If your product has a healthy CAC:LTV ratio, proceed with paid ads.

Step 2 → Choose an ICP

Step 3 → Select advertising channels

Step 4 → Write a Marketing Pitch

Step 5 → Customize your message for different customer segments to ensure relevance

Step 6 → Design at least two ad creatives (e.g., images, sketches, videos, text ads) that reflect your marketing pitch.

Step 1 - LTV: CAC Ratio

Base Assumptions:

- AOV (ASP) = 350 INR

- Purchase Frequency per Year = 4 times

- Customer Lifespan = 2 years

- Total Marketing Spend = 50,000 INR

- New Customers Acquired = 125

Step 1: Calculating CAC

By Formula - Marketing spends/ Customers acquired

= 50000/ 125 = 400 rs

Step 2: Calculating LTV

By Formula= ASP X Frequency of purchase X Customer Life Span

= 350 x 4 x 2

= 2800

LTV to CAC ratio is

2800/400

= 4 :1

Since its above the ideal benchmark of 3:1 - Paid Marketing is definitely a channel to explore and experiment with.

Step 2 - Choose an ICP

Step 3 - Select Advertising Channels

Basis this channel analysis Google Search is the most feasible channel for experimentation in the current stage at a CAC of 400 rs ( roughly) followed by Facebook and Meta.

Will not use Youtube at the moment for it helps with brand building and not acquisiton( interrupting user's flow of video) hence not the ideal channel for our use case at the moment.

Step 4 - Marketing Pitch

Option 1

Pure, Safe, and Effective Hair Care for Every Mom-To-Be

Indulge in Ayurvedic hair care that’s 100% natural, safe, and effective—designed to meet the needs of every mom, from pregnancy to postpartum

Option 2

For the Purest, Healthiest Hair. From Pregnancy to Postpartum.

Indulge in Ayurvedic hair care that’s 100% natural, safe, and effective—designed to meet the needs of every mom, from pregnancy to postpartum.

Step 5 - Messaging for every customer segment within the ICP

Customer Segment | |

Moms undergoing pregnancy for the first time | First Pregnancy? Experience Safe, Natural Hair Care. |

Moms who are breastfeeding | Safe & Natural Hair Care for Breastfeeding Moms. |

Moms who have had to give up things they loved due to pregnancy. Eg hair color | Beautiful, Chemical-Free Henna Color. |

Moms going through post partum | Rebuild Your Hair’s Health, Postpartum. |

Moms going through hair loss due to change in hormones due to pregnancy |

|

Ad Creatives 😀

(Understand, where does organic intent for your product begins?)

Step 1 → Identify complementary products used by your ICP

Step 2 → Use the selection framework

Channel Name | Time to go live | Tech Effort | New users we can get (monthly) | New Users we can get in Month 1 | New Users we can get in Month 2 | New Users we can get in Month 3 |

Integration Partner 1 | | |||||

Integration Partner 2 | | |||||

Integration Partner 3 | | |

Step 3 → Collaborate with necessary stakeholders

Step 4 → Map the customer journey

Step 3 → Design the wireframe with the new integration

Step 3 → Run pilot tests before launching

Step 3 → Measure post-integration metrics

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.